24+ split mortgage payments

Web What Are Biweekly Mortgage Payments A biweekly mortgage payment is a mortgage option where instead of 12 monthly payments every year you make half a. Choose Smart Apply Easily.

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

If you make a down payment of less than 20 you will be required to take out private.

. Ad Compare Loans Calculate Payments - All Online. Web Step 1 Find out if your bank allows biweekly mortgages. Some banks do not but a biweekly mortgage as the name suggests is paid every two weeks.

With Chase automatic payments from your checking account you choose the free option that works best for you and your budget. By paying 1000 twice a month or 24 times per year you would make a total of 24000 in payments the same as you. Biweekly payments would save a borrower nearly 30000 in interest charges and.

Paying in this manner will. Best Mortgage Lenders in California. Web Mortgage payments are made up of your principal and interest payments.

Web What happens if I split my mortgage payment into two payments. Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web What Is A Split Mortgage A split mortgage or a split rate home loan is a loan feature that allows you to split your home loan into multiple loan accounts that.

Web Bi-Weekly Payment Plans Your lender probably offers a bi-weekly mortgage payment plan where you make a half-payment every two weeks instead of a full. Web The traditional monthly mortgage payment calculation includes. Web Say your mortgage is 2000 per month.

VA Loan Expertise and Personal Service. The amount of money you borrowed. Ad 5 Best Home Loan Lenders Compared Reviewed.

Comparisons Trusted by 55000000. Web For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of 14400 per year. Check How Much Home Loan You Can Afford.

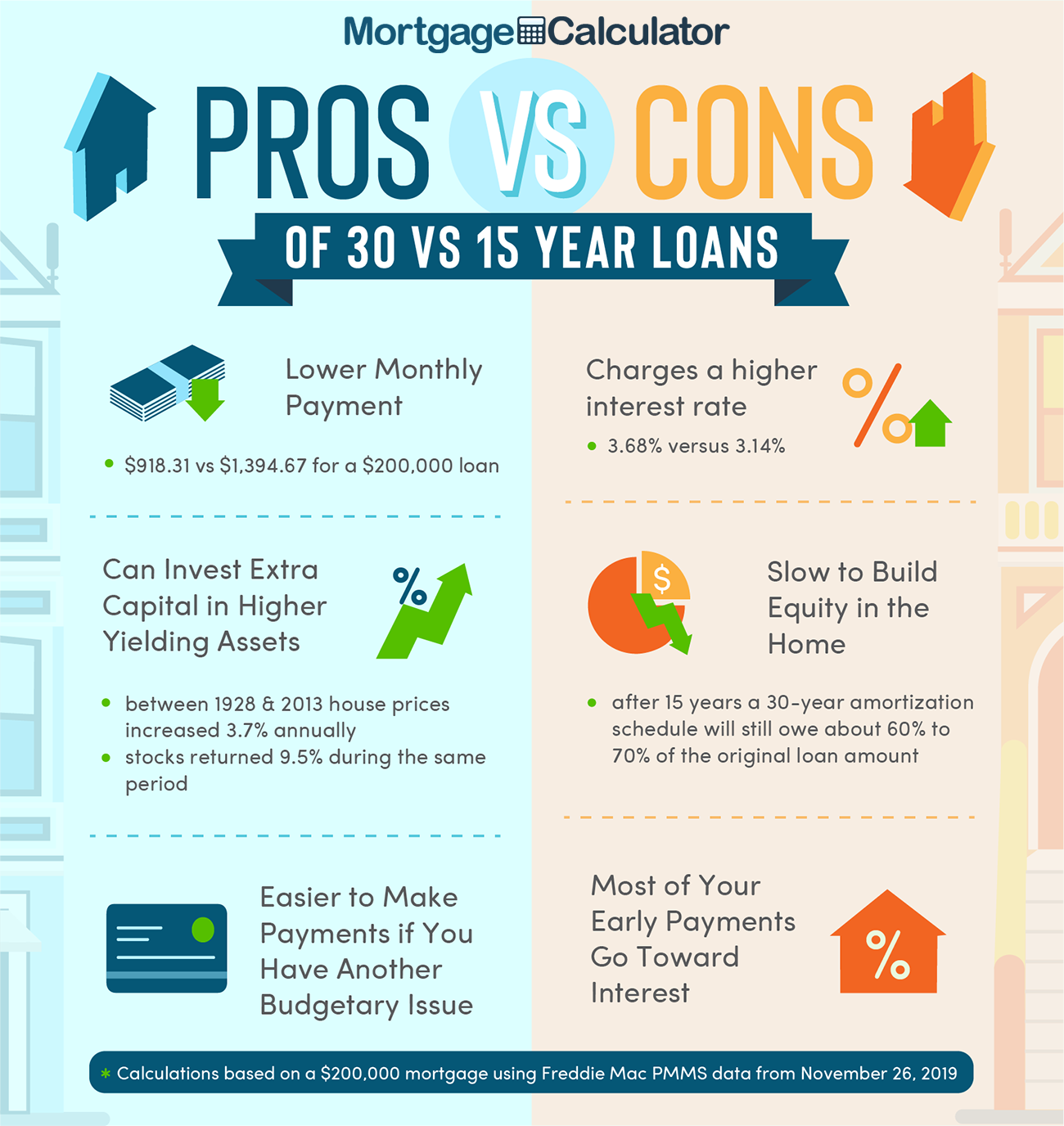

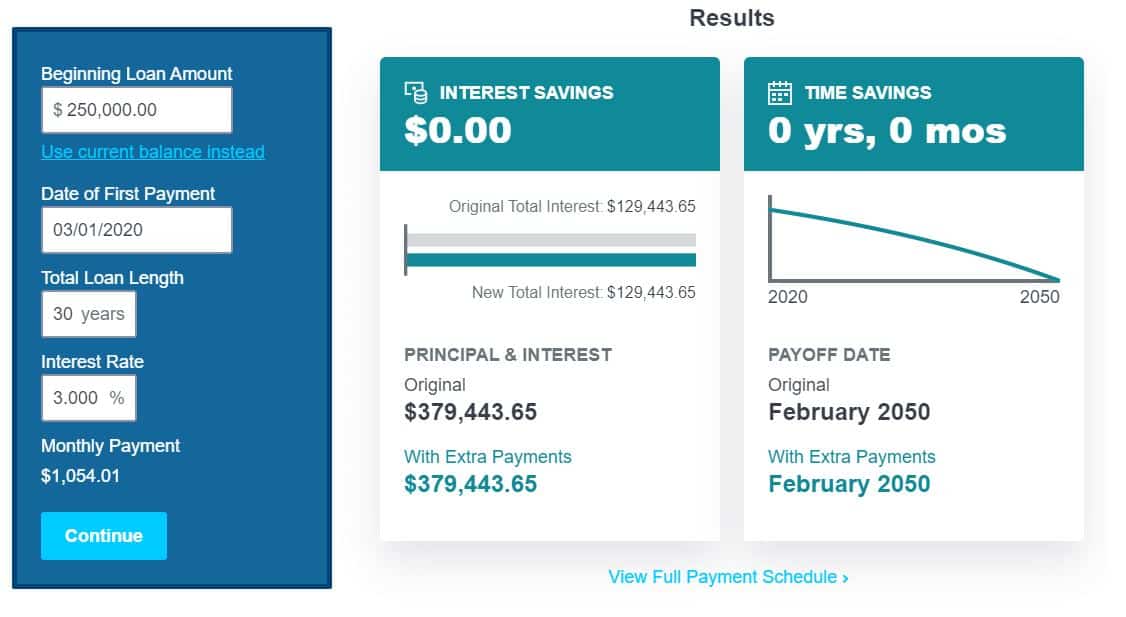

Get Your Quote Today. Trusted VA Loan Lender of 300000 Proud Veteran Homeowners Nationwide. Web Zeibert gives the example of a 30-year fixed loan of 250000 at a 4 interest rate.

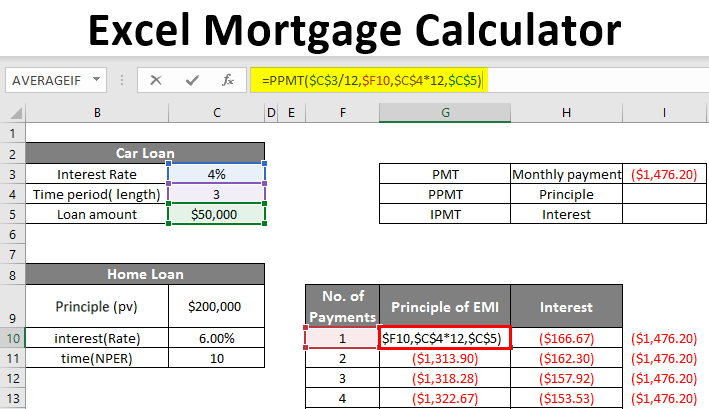

Web Using A Mortgage Calculator For Your Monthly Payment Breakdown. It is the best way to ensure your. Special Offers Just a Click Away.

You can calculate your monthly payment manually excluding taxes and insurance by. What you do is take the normal 30-year mortgage you have and instead of making the. Contact a Loan Specialist.

The cost of the loan. Lowest Rates Easy Online Process.

14405 Big Canyon Rd Lower Lake Ca 95461 Zillow

Allied Payment Network Expands Sales Team To Support New Market Expansion Growing Client Base

S 1

Financial Access Under The Microscope1 In Imf Working Papers Volume 2018 Issue 208 2018

Thisweek Hilliard 3 24 By The Columbus Dispatch Issuu

Loan Insurance What Is It About And Things To Check Before Applying Moneytap

Is It Realistic For A Mortgage Loan Originator To Make Six Figures Quora

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

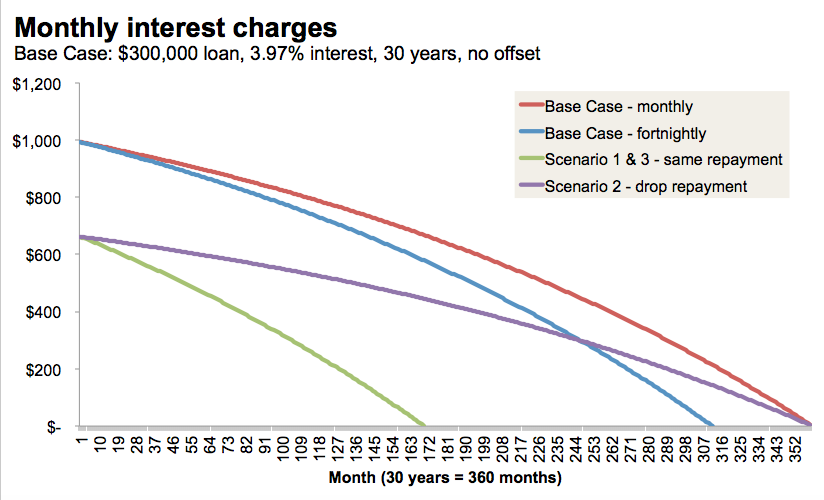

Will A Weekly Bimonthly Or Biweekly Payment Mortgage Really Save Me Money

2011 Kbc Group Analist Be

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Student Information Service Amp Fee Payments Service Hei Services

Free 6 Mortgage Quote Request Samples In Pdf

Should I Pay Down My Mortgage Or Use An Offset Account Money School

:max_bytes(150000):strip_icc()/WhatAreTheStagesoftheForeclosureProcess_-1b6bfb07ccc8494b9960a85a79ef0d7e.jpg)

How To Make Biweekly Mortgage Payments

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

Mortgage Calculator With Pmi And Taxes Nerdwallet