20+ paycheck calculator south dakota

Simply enter their federal and state W-4. Your household income location filing status and number of personal.

Army Pre Retirement Briefing Hq Army Retirement Services Dape Rso 200 Stovall St Alexandria Va March Ppt Download

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. You may also contact. North dakota child support calculator. The state income tax rate in South Dakota is 0 while federal income tax rates range from 10 to 37 depending on your income.

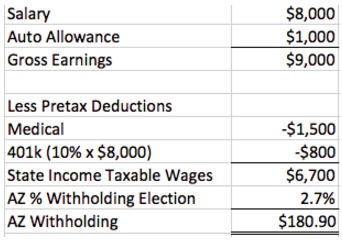

Figure out your filing status work out your adjusted gross. North dakota paycheck calculator. Calculate your South Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South Dakota.

The median household income is 56894 2017. South Dakota Paycheck Calculator. This South Dakota hourly paycheck.

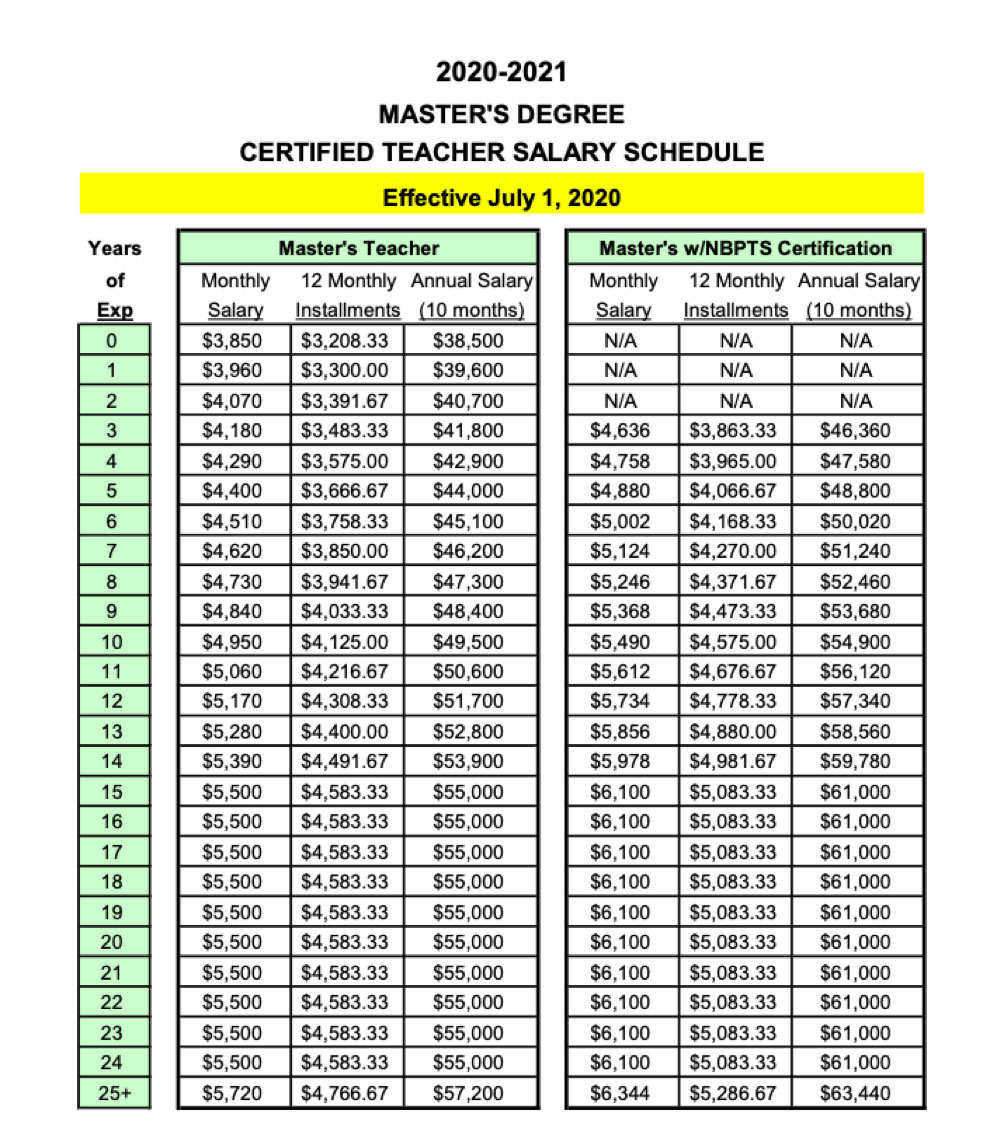

South Dakota Salary Calculator for 2022. Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck calculator. The South Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates.

As an employer in South Dakota you are responsible for paying unemployment insurance to the state. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in South Dakota. Use the south dakota dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay.

Just enter the wages tax. Well do the math for youall you need to do is. South Dakota has a population of under 1 million 2019 and is home to Mount Rushmore and the Badland.

Use ADPs South Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This free easy to use payroll calculator will calculate your take home pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in South Dakota.

South dakota child support calculator. Paycheck calculator south dakota. The rate ranges from 0 all the way up to 93 on the first 15000 in.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. After tax wages is the gross annual wage less the total of federal income tax state income tax and social securityFICA tax. This income tax calculator can help estimate your average.

Supports hourly salary income and multiple pay frequencies.

South Dakota Hourly Paycheck Calculator Gusto

:max_bytes(150000):strip_icc()/Form433-A-f714c68e69034c62ab838bc9e31a1da2.jpg)

How To File Form 433 A

Top 5 Best Real Estate Investment Markets In North Dakota

South Dakota Hourly Paycheck Calculator Gusto

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Kings Kourt Apartments 2500 S Dakota Ave Sioux Falls Sd Rentcafe

How Are Payroll Taxes Calculated State Income Taxes Workest

March 2021 Newsletter By The State Bar Of South Dakota Issuu

South Dakota Income Tax Calculator Smartasset

News Archives Rji International Cpas

Paycheck Calculator Us Apps On Google Play

Medreps Salary Calculator Medical Sales Careers

Characteristics Of Minimum Wage Workers 2020 Bls Reports U S Bureau Of Labor Statistics

Paycheck Calculator Apo Bookkeeping